Special Features

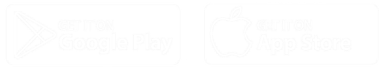

Multiple Saving Systems

Bloom! supports diverse saving systems including daily savings, group contributions, goal-based savings, and emergency funds. Whether you're part of a rotating savings group or saving individually, Bloom adapts to your preferred method—making it easy for anyone to stay consistent and achieve their financial goals on their own terms.

Join Multiple Groups

With Bloom!, users can belong to multiple savings groups simultaneously. Whether it’s a family fund, a business circle, or a community project, you can manage all your group contributions from one app. Each group is tracked separately, offering flexibility, transparency, and a holistic view of your financial commitments.

Customizable Saving Plans

Bloom! allows savers to tailor their saving schemes to fit their lifestyle and income patterns. Set custom saving amounts, durations, reminders, and goals—whether you're saving daily, weekly, or monthly. Personalization makes it easier to stay on track, remain motivated, and build a financial plan that actually works for you.

Our Creed.

Our innovative technologies and marketing approach will inspire a Savings culture among the low and mid income earners. As well as provide easy access to tailored LOAN products.

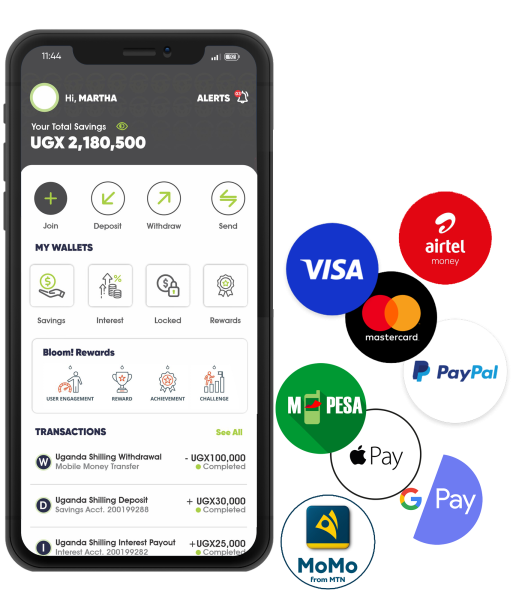

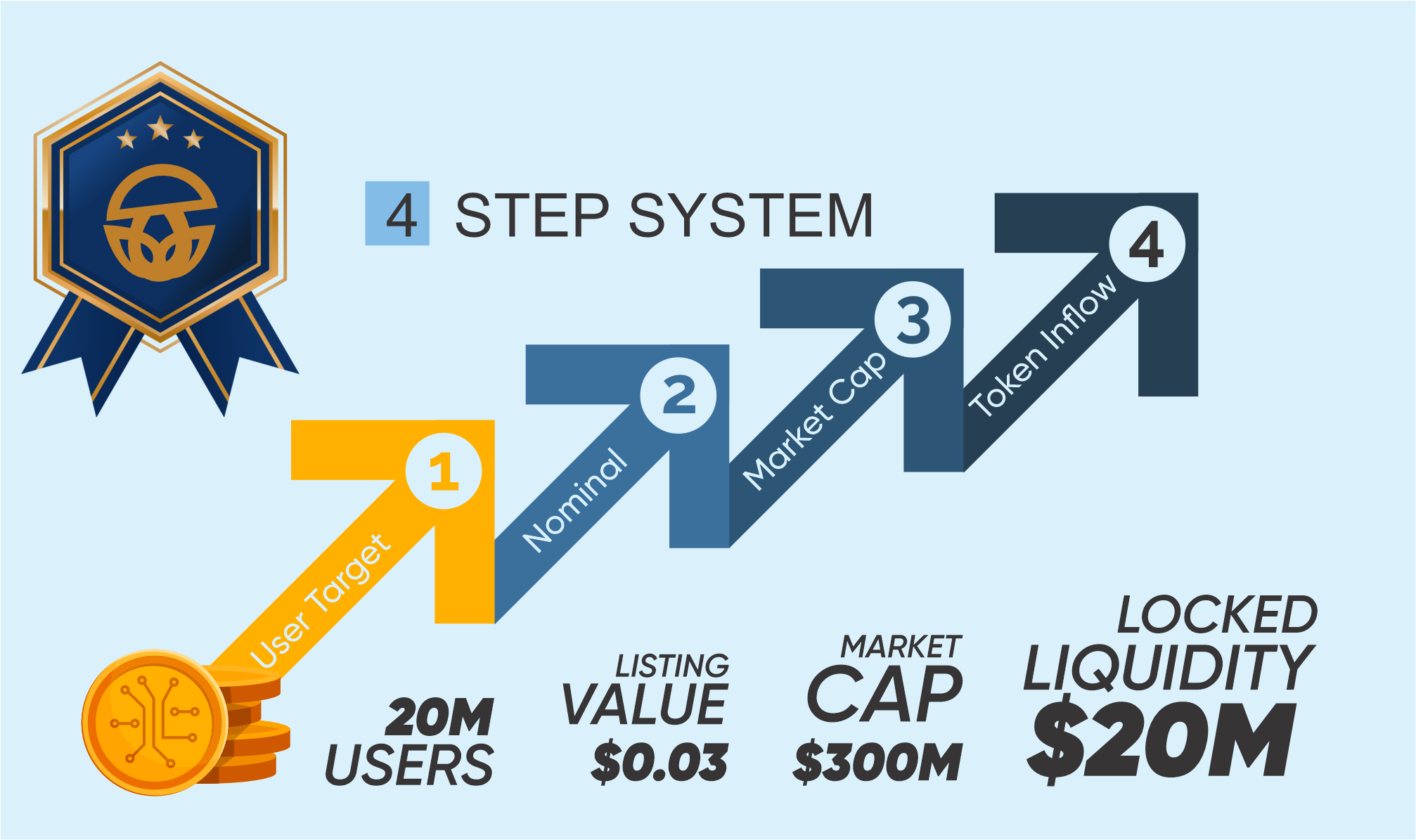

Bloom! Rollout Plan.

Bloom! Opportunity.

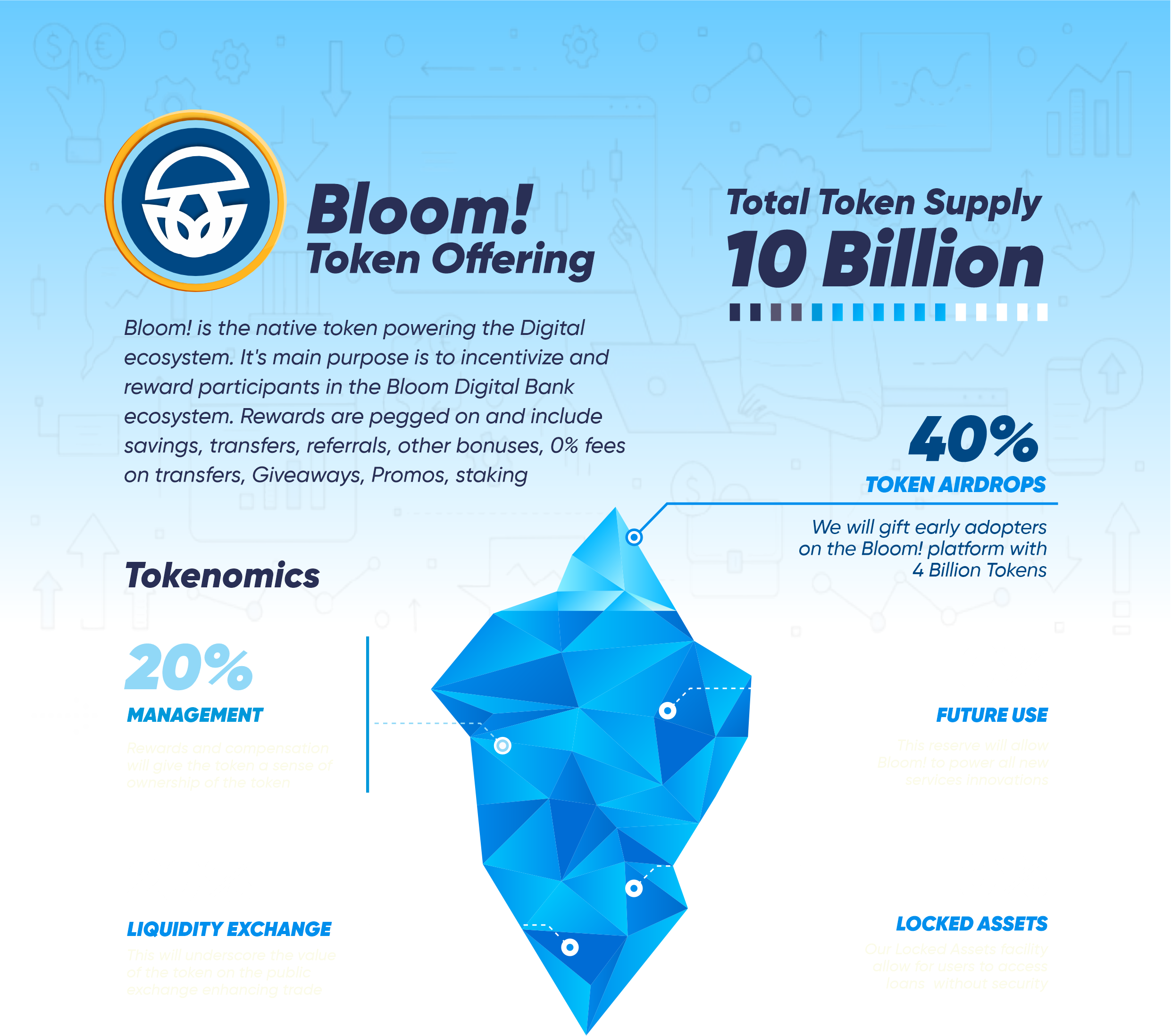

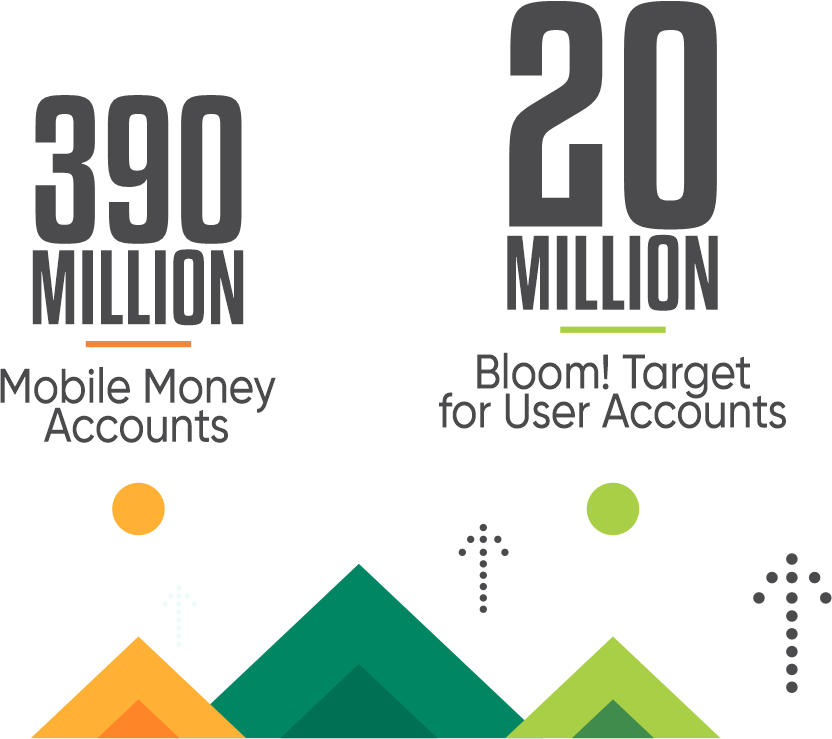

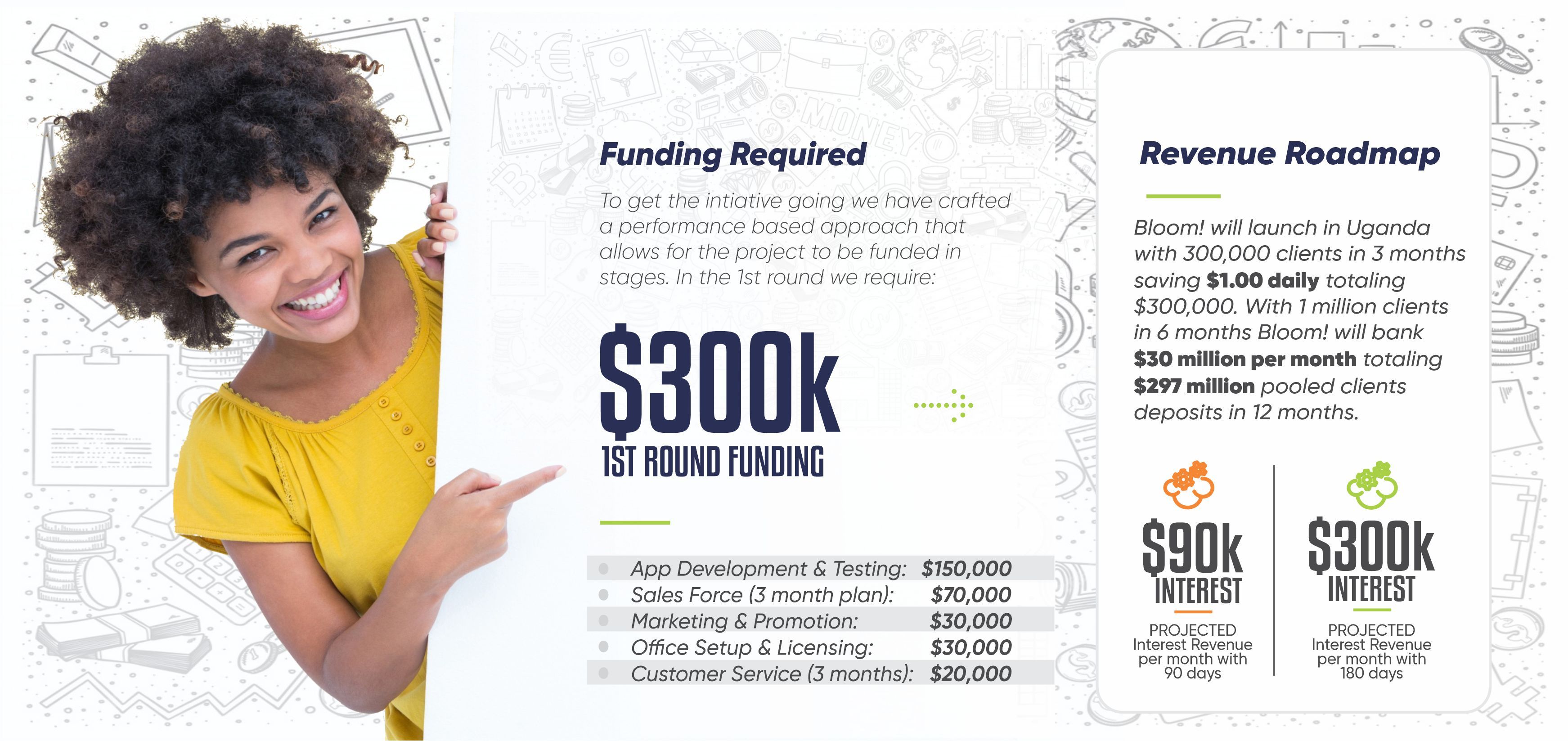

There are over 390 million registered mobile money accounts in East Africa with 55% active users. Bloom! can leverage 10% of this 210 million active users as our saving clients. We project 5% daily withdrawals at 3% transaction fees. The 33% revenue sharing with the telcos would the projected revenues are $1,764,000 million per year.Bloom! presents a unique opportunity for investors to tap into Africa’s fast-growing fintech landscape while creating measurable social impact. With over 400 million unbanked adults across the continent, there’s a massive untapped market for inclusive financial services. Bloom’s model—digital community savings and microcredit—targets this underserved segment with scalable, tech-driven solutions tailored to real grassroots needs.

Investors benefit from an agile, high-growth venture operating in markets with rising mobile penetration, fintech-friendly regulation, and increasing demand for savings and credit tools. With low client acquisition costs, strong retention via community networks, and a purpose-built platform, Bloom offers high return potential with reduced risk.

Bloom! Technologies LTD.

P.O. Box 3865 Kampala, Uganda

HQ. Bukasa, Muyenga

Kampala City - Uganda

T. +256 722 980 123

T. +256 707 883 380

E. This email address is being protected from spambots. You need JavaScript enabled to view it.

© 2025 Bloom! Technologies Ltd.

All rights Reserved.

Using the App Policy.

MARKET PRESENCE: UGANDA | KENYA | TANZANIA | DR CONGO | RWANDA BURUNDI | SOUTH SUDAN | ETHIOPIA | ZAMBIA | ZIMBABWE